Climake Newsletter #26: Notes from the Big Green Apple, New York's Climate Week

The Climake Newsletter offers quick digests and insights around what is happening in climate finance. While Climake’s current focus of work is India-centric, we capture a global perspective of climate finance in this newsletter on a fortnightly basis.

September to November is conference season in the climate world. This year’s festivities kicked off with two of our favourite conferences getting bigger and better. Some of us spent time in IIT Madras, where Climafix, now in its second year, brought together 100+ climate startups and pretty much every climate investor in the country. The rest of us were off to New York for the Climate Week, in what seemed like one of the largest gathering of climate action players after COP. We recap much of our discussions from the week below but we can’t help but start with a special mention to all the art that brought climate dialogue to public notice. Our two favourites: the drone show that lit up the Manhattan night sky and images from NASA that led to a digital art show/exhibits on the future of energy and water.

Climate Finance by the Numbers

As a prelude to our recap of NY Climate Week, the key numbers in this newsletter focus on a stocktaking of global climate action and climate finance.

30%

Share of renewables in the global energy production

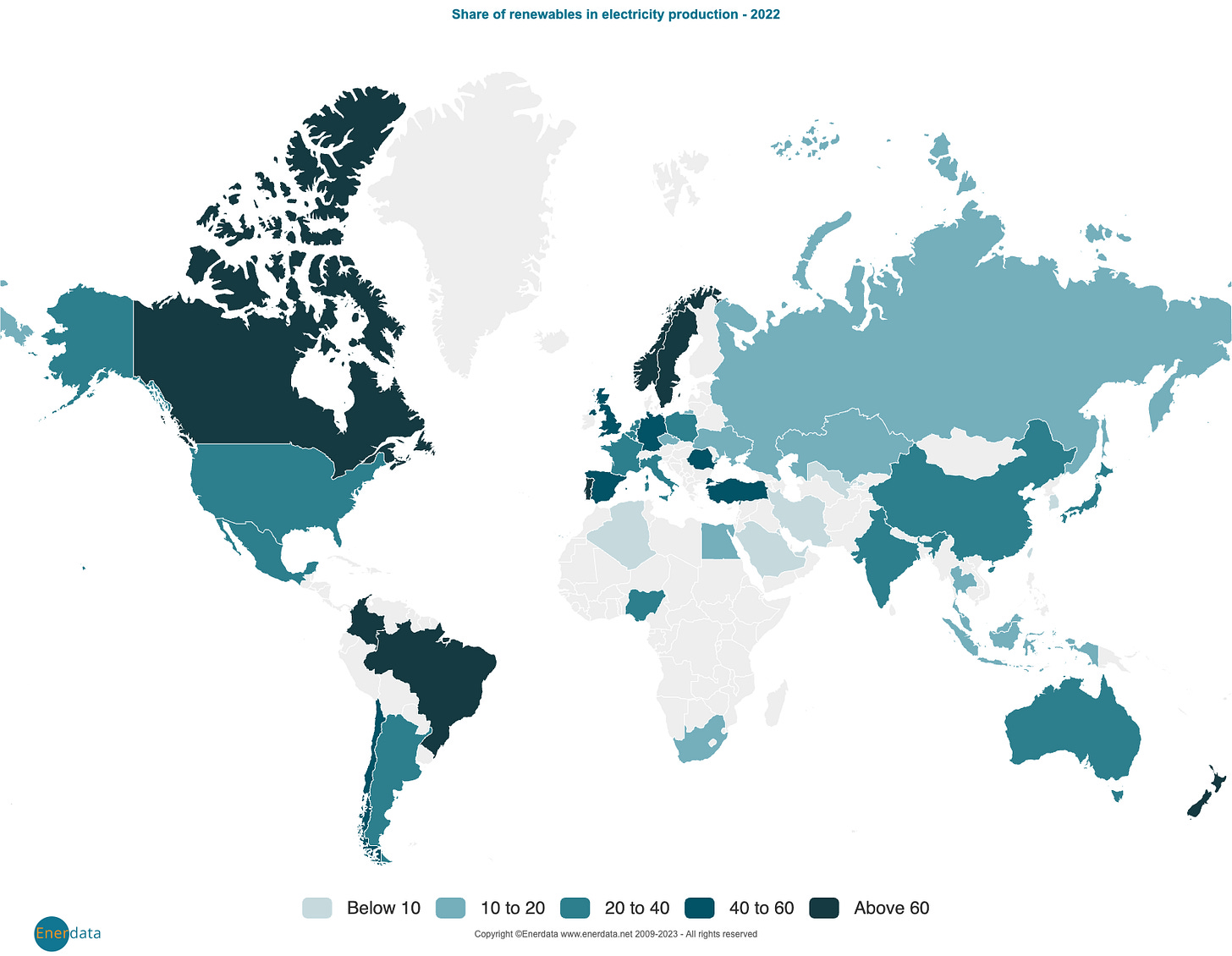

Solar and wind energy achieved grid parity about a decade ago; this means that investing in these renewable energy projects is not just good for the environment, it’s also good business. Renewables also get the largest share of climate investments, leading to significant year-on-year growth. By the end of 2022, renewable energy accounted for 30% of all global power generation, up from 20% in 2010. There are considerable variations in how this is spread out globally, with Canada, Brazil, New Zealand and the Nordic countries leading the charge.

We believe that even with all the growth we have seen in the past decade, the sector continues to have a significant growth potential. This growth is being driven not just by state utilities but also the largest corporate consumers. 400+ of the largest global companies are now signatories to the RE100, a commitment to move to 100% renewable power not just in the direct operations but the entire value chain of these businesses. The Climate Group estimates that this adds up to 440+ Twh of energy demand per annum, enough to drive sectoral growth for the next decade.

As countries start to exceed 50% of power generation from renewable sources, there are incidental benefits too. Larger share of solar and wind power require modernised grids, better technology for demand estimation and load management: all projects that US, Europe and Australia are implementing.

14%

Share of electric cars in the global car sales

If renewable energy is the lowest hanging fruit for countries and corporations looking to invest in climate action, electric mobility is quickly becoming a close second. EV sales exceeded 10 million for the first time in 2022, with 14% of all global car sales being electric vehicles. While a huge jump from 2020, we should put the number in perspective: at about 26 million overall, the global share of electric cars is still less than 2% of the 1.4 billion vehicles on the road today. But this could change quickly, with more than 30% of car sales expected to be EVs by 2030.

Electric mobility also goes beyond passenger cars. In China and in India, two wheelers form the largest share of the electric vehicles sold. In India, three wheelers, carrying both goods and passengers, have the second largest share of the EV market. As with solar and wind power, economics matter. Lifetime cost of ownership for commercial electric vehicles is trending lower than ICE vehicles, making it attractive for corporations to seriously consider electric transporation. 120+ large global corporations have committed to EV100, expecting to add nearly 6 million vehicles to commercial fleets by 2030.

However, unlike renewable energy, EV adoption is not merely about selling vehicles. A supporting ecosystem of charging infrastructure needs to be created. And EVs are only as effective in abating emissions as the source of electricity they consume. This is a point of contention for a country like India where coal is the source of 60%+ of electricity. For EVs to be impactful, then, the growth in both renewable energy and mobility would need to happen in tandem.

<10%

Share of adaptation funding in global climate finance

Ask anyone working on designing a climate action strategy and they will tell you that adaptation is way, way harder than mitigation. Part of the problem is that adaptation is a nebulous concept. Impact of mitigation investments can be clearly measured as tons of GHG emissions reduced or avoided. Adaptation, by its very nature is investing in activities that make the planet, cities and populations more resilient to the expected negative impact of climate change. That is a wide definition and experts continue to differ on what adaptation includes. Measuring the outcomes and impact of such adaptation spends is another challenge.

That said, everyone agrees that more needs to be done. Even if GHG emissions were to drop to zero today, the world will continue to become a worse place to live in, with many more extreme weather occurences. UNEP estimates that annual adaptation costs in developing economies will be in the range of USD 155 to USD 330 billion by 2030. Today, adaptation spends are a fraction of that, with total investments estimated at USD 46 billion for 2020.

Adaptation has so far been largely a public service with only 2.2% of the adaptation investment coming from private sector in 2019 and 2020. But private sector is finally starting to realise the importance of acting now - IFC estimates that $800 million invested in early warning systems can reduce climate disaster losses by $3-16 billion a year in developing countries. Scaling both the overall adaptation finance, and the private sector contribution, is an urgent need. While many public development banks and funds like GCF have committed to more adaptation investments, the proof will be in execution over the next decade.

THE BIG READ

Notes from the Big Apple: New York’s Climate Week

Outside of the COP conferences, New York’s Climate Week is arguably the largest congregation of the climate action ecosystem. Startups, investors, ecosystem enablers, policy makers, and more, come for the multitude of events, programs, and interactions that show a global pulse of how climate action and innovations are evolving.

We just arrived back from the craziness that is New York Climate Week. It was our first time attending this event in person and we must say we were unprepared for just how busy the week gets. For the uninitiated, NYC Climate Week is not one event. Yes, the Climate Group kicks off the week with a couple of days of panel discussions. But there are hundreds of diverse events that are organized outside of this official event; everything from art shows, to innovation showcases, to discussions around technology and finance. Navigating the Climate Week event page - with all its 400+ choices - and finding your way to events happening all over New York City (Manhattan, Brooklyn and even the Bronx) could qualify as an Olympic sport.

While Climate Week becomes the talk of the town for one week, what matters more, and has a longer ranging implication, is the talk that actually takes place in all the public and private forums and events.

For its 2023 vintage, a lot of the talk at Climate Week was a repeat of what we have been saying and hearing for a few years now: more work and urgency is needed around climate action in general and adapation in particular; it needs a lot of money and no one quite knows how to find all the capital. But amongst all these discussions, many nuances started to emerge.

Here are our distilled key learnings and insights from what was said at Climate Week.

Corporations are starting to change the way they do business as they focus on climate action

The first era of corporate climate action, starting around a decade ago, started with large companies experimenting with building foundations, adding corporate investing arms and allocating CSR capital to make small commitments to climate. The second era, which is also a lot more impactful, has corporations re-evaluating their core businesses and supply chains and getting ready to make changes to how they run their operations and build stronger systems to account for significant change. This second era of climate action was prominently at the center stage this entire Climate Week.

Whether it was three brilliant days of climate talks by Ingka, or Saint-Gobain taking a relook on how climate change will impact construction, and consequently, their core glass business, we were impressed by the large investment commitments and the steps towards sustainability the largest corporations are taking. We met many a Chief Sustainability Officer (CSO) driving core corporate strategy. Tangentially, Apple’s brilliant report of their climate efforts came out the same week and adds to the sentiment echoed in talks hosted or attended by other technology giants.

Societies are still not changing fast enough

While everyone at Climate Week seems committed to changing the way they live and work, we realise it can be one big echo chamber of folks already driving climate action. Does that translate into how the rest of the population is thinking about changing lives and lifestyles? We believe the answer is no.

By and large, climate action plans still assume that consumer behaviours and lifestyles will not change: as a society, we will continue to grow and consume resources as we do now. This might start to be more recognised in a few years’ time but as of 2023, the Climate Week events open to the public outside the climate action sector had a soft messaging tone: art shows and sustainable agriculture tours that simply do not emphasise the gravity of the situation enough in our view.

New York did witness one prominent action of public expression towards climate action: a protest on the streets of New York at the lack of pace towards it, albeit one more aimed at the delegates of the United Nations General Assembly (UNGA) that precedes Climate Week. Despite being the largest climate protest since the COVID-19 pandemic and a sign of public awareness about climate action, the protest did highlight the issue on societies being able to change; despite being the group that feels the most from its effects, they are also least capable of doing something about climate change.

Capital allocation is starting to make sense, somewhat

It is no secret that capital allocation towards climate action has been lagging. As time, innovations, and issues have progressed, we are starting to see funders and financiers aligning better towards the needs of climate action. Here are the top three things that speak to this, that we heard from the funds and capital allocators we met:

New climate-only funds are building niche investment thesis that factor in the unique requirements of investing in the sector. These funds are comfortable with themes that the previous generation of technology first investors have not been, including investing in asset heavy businesses and those that work on solving B2B supply chain challenges.

If corporations, not consumers are at the forefront of climate action, investors are following suit with funds and investments targeted towards decarbonizing the supply chain and investing in startups that are ‘solving climate challenges of large corporations’ at their core.

Capital allocation is moving away from ‘venture equity only’ approach to include project equity, debt/project finance and infrastructure trusts to provide differential forms of capital needed at each stage of growth. One constant theme we heard was that while innovation is necessary, a lot of technologies we need already exist and focus needs to be on finding ways to scale businesses to billions of users.

Funds are finding new ways to drive scale

Climate funds are starting to realise that as their investee companies start to grow, they need to think beyond their own investment corpus and enable the entire ecosystem. We met a series B+ fund, able to invest upto $50 million directly into a venture, but with the knowledge that each of these companies they back could need upto $1 billion dollars to scale. Rather than trying to raise a bigger fund themselves, they are finding LPs who are willing to co-invest much larger amounts as the investee businesses scale.

Another fund we met is building partnerships with large corporations – their thesis being that investee companies will sell to these corporations and as they need more capital, their customers could be the strongest champions and capital providers.

Equality and equity are starting to get mindshare

Adaptation is still a hard problem to comprehend and solve. The many panels we heard on sustainable agriculture, agro-forestry and nature based solultions seemed affected by the gloomy carbon markets. While many hopes are pinned on COP28 bringing in policy clarity to keep building voluntary carbon markets as a way to finance solutions where no commercial returns exist, it is early days for both climate action and climate finance in these areas.

That said, we saw signs of capital allocators adding social and gender impact as additional criteria as they scale their climate investments. This focus on vulnerable populations who will be most impacted by climate change is a welcome addition to many funds’ investment thesis and one that we hope more funds will continue to build on.

Overall, the week left us with a sense of optimism that things are changing for the better each year. More capital, and more relevant capital is now chasing climate businesses. Not everyone can still get funded and a lot of the world view is still US and Western European-centric but we are slowly getting around to understand that climate action and climate investing will need frameworks that cannot be borrowed from technology investing.

We believe that pathways for scaling existing, commercially viable solutions now exist. The big gap now is funding solutions that create climate positive impacts without adequate commercial returns. Those - particularly the ones focused on the most vulnerable populations and adaptation - are going to need new forms of capital and returns. That is one discussion we are looking to reopen at COP28 in a few months’ time.

That’s it for Edition #26 of our newsletter.

As always, send all feedback, compliments and brickbats our way. And of course, we do appreciate you spreading the word about this newsletter.

We’re building something collaborative with you and the more the merrier!

Best,

Simmi Sareen and Shravan Shankar