The Climake Newsletter #18: India's listed climate techs

+ The role of subsidies in climate action; electrification beyond EVs; insurance and climate-related natural disasters; the bullish EV market for India (feat. luxury 4-wheelers not called Tesla)

The Climake Newsletter offers quick digests and insights around what is happening in climate finance. While Climake’s current focus of work is India-centric, we will capture a global perspective of climate finance in this newsletter on a fortnightly basis.

At Climake HQ, we are interested in cases around unintended effects to specific actions. After all, a significant part of climate change issues stem from our neglect of the effects (warming and weather effects) of a by-product (GHG emissions) of an activity (fossil fuels as energy sources) that provides value (energy to power buildings, industries, vehicles, etc.)

Which is why we got very interested by an article in The Economist on the role and influence subsidies have on environmental issues in India faces (air pollution, coal reliance, etc.) These are not often subsidies in the way we think of, e.g. a reduced price for farmers to use fertilizers, but can be restrictions, concessions, and “production-linked incentives” in areas like electricity, the railways, and solar panel manufacturing, can have unintended environmental consequences.

It is definitely worth a read, and make you think on other actions that have unintended effects around climate change.

Climate Finance by the Numbers

68%

This might be an April 2021 statistics, but we felt it a worthwhile number to highlight on the back of the COP26 Summit.

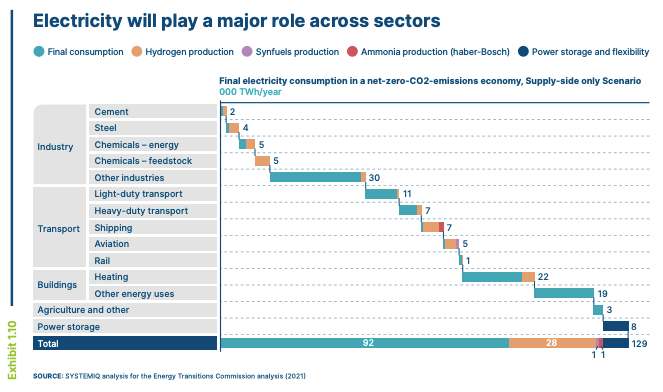

Direct electrification relates to equipment, etc. using electricity as a fuel source, as opposed to other forms of energy, mainly combustion. An example of this is electric vehicles which generate energy from electricity, as compared to internal combustion engine (ICE) cars that use petrol and diesel to generate energy. The common output of our renewable energy sources is electricity, so the more that we can operate things using direct electricity - the demand-side - the greater our potential to use clean energy source to operate more of the global economy. So the theory goes.

Currently only 19% of energy use is from direct electrification, which tells you a lot about the leap that needs to be taken.

Our approach on that demand-side, of getting more things to be powered by electricity is weak. EVs tend to dominate most conversations where we want to throw a spotlight on electrification, and while they are significant, they are small proportion of other areas that need targeting.

Heating buildings and industrial processes, are two examples of areas that need greater adoption of direct electricity in equipment and operations. There is an operational positive, beyond its climate angle, to using clean electricity. It can eliminate up to half to two-thirds of energy that is lost as waste heat when using coal or natural gas.

There is another, more complex side to this, which goes back to the supply side: we will need to significantly increase our supply of clean electricity to make up for moving form other energy sources. The ETC estimates getting to that 68% figure will require increasing clean electricity supply by over 400%. And being clean is crucial for us to reduce GHG emissions associated with energy use, which is the basic aim.

66%

The proportion of global losses to natural disasters that are uninsured

We covered losses from natural disasters and the paltry insurance coverage in one of our earlier newsletters, but this time we wanted to focus more on the insurance angle of this context, that helps individuals, businesses, and even countries recover from damages faced by natural catastrophes.

In 2019, losses from natural disasters amounted to USD 207 billion. Only USD 70 billion of this was insured, with a significant proportion in more developed economies.

As climate change increases the severity of natural disasters, we can expect damage and economic losses to increase.

For an industry that defines its work on understanding risk, climate change effects have weirdly been underplayed. France’s central bank recently conducted what is considered “the first climate stress test on a country’s financial sector” and found that natural disaster-related insurance claims could increase up to five-fold in the country, causing premiums to increase by as much as 200% over 30 years. This was in 2021.

Even reinsurance providers - often called “the global economy’s last backstop for the costs of climate chaos”, as they help to bail out insurance companies - were found to be susceptible to underestimating climate change risk, by up to 33-50%, as per a S&P analysis in September 2021.

The industry is becoming more aware and starting to flex their weight. Insurers in Australia and Europe are excluding investing in coal and other fossil fuels as contributors to climate change effects. The expectations for more climate-related disclosures - such as the Task Force on Climate-Related Financial Disclosures - will make organizations plan for adaptation and resilience approaches, providing more information to insurance companies to place further incentives (or pressure) on such companies. Reinsurance companies like SwissRe, who paid out $1.7 billion in natural catastrophe claims in 2020, are expanding their focus on climate change-related protection.

But the reality is that just 33% of natural disaster losses are covered. The question needs to be asked that, as climate change effects increases in decision-making and modelling, will the potential for higher premiums and too high risk industries or geographies, keep that low percentage in place, or even reduce it?

One activity to know more, and a self-plug for us, is an upcoming event, on December 15th, on Managing climate risks in support of economic growth and societal development, hosted by Niti Aayog, SwissRe, and the Swiss Embassy in India, where Climake has been invited to be a part of panel session. If you are interested in attending, do drop a message to us, and we’ll speak to the organizers about your participation.

30%

The targeted share of electric vehicles in the Indian state of Goa by 2025

We saw something quite surprising the other day.

Audi has sold at least 1 luxury EV - costing a minimum of INR 1 crore (~USD 130,000) - every day since June. A 4-wheeler luxury EV. In India. In 2021.

2 and 3 wheelers have always been proposed as the bellweather of the Indian EV market. So what do we make of more than USD 15 million of luxury 4-wheeler EVs have been sold in the country, enough to make Audi increase their planned supply by 3 to 4 times, and explore localizing EV manufacturing in the country.

EVs can truly be labelled as the next sunrise sector for climate action in India. But such hype tends to fall flat at the lack of details. Audi has only sold about 130 or so of those cars - a tiny tiny drop in the growing EV sea, never mind the wider transport ocean - which is not likely to be difficult to find buyers for.

We need promise to be met by steps that support a wider environment to meet the planned demand and growth.

That’s what the Goa Electric Mobility Promotion Policy (GEMPP) does.

Its target of achieving a 30% share of EVs is also supported by ones around the infrastructure and wider ecosystem that has to go with making EVs more easily adoptable for the masses. This is unlike India’s 2017 very broad and thin on details target to achieve 100% EVs by 2030. (The country has now stated a more realistic target share of 30% of private cars, 70% for commercial vehicles and 80% for two- and three-wheelers by 2030.)

From consumer incentives around tax breaks, subsidies around land and electricity for EV infrastructure and charging stations, prioritization of getting commercial vehicles to shift, support for building skilled labour and capacity for a target of 10,000 people to be employed in the sector, to backing this all up with new government institutional infrastructure to scale EV adoption, the GMEPP has a lot going for it.

Yes, Goa is small, more developed, and more urbanized than most other states, but it does have the 15th highest vehicle density in the world, with 625 vehicles for every 1,000 people. And that makes it a fascinating microcosm for a blueprint for others to adopt.

THE BIG READ

India’s Listed Climate techs

We take a look at Indian climate tech companies that are publicly listed and try to predict what can drive and scale more public companies to go green, and get more climate tech startups to go public.

An IPO is the ultimate exit strategy on every startup deck. Listing on public markets is more than a source of capital, it is a sign that a business is mature, stable and willing to subject itself to scrutiny beyond what private investors ask for.

Public markets are, therefore, looked on as a sort of financing final frontier for startups and scale-focused private companies. A public listing opens up access to larger and more diverse pools of capital - to retail and institutional investors - and does so in a way that can be a more favourable way of raising money as compared to private equity or commercial debt. It also gives private backers and investors that have supported and influenced such ventures the opportunity to exit and make their own returns.

If you are a listed climate-focused company, however, there is a lot more at play. There is potentially more opportunity compared to most other sectors. We delve into the world of currently listed Indian climate tech firms, and do a bit of crystal gazing on what it means for the climate finance ecosystem.

A handy warning before we start: please read it as our commentary on broader climate tech ecosystem. This is not meant to be and should not be construed as a stock recommendation.

India’s public-listed climate techs

We identified 43 climate-focused Indian public-listed companies, 41 of which were listed in Indian exchanges - the NSE or BSE - and two renewable energy companies, Renew Power and Azure Energy listed on NASDAQ and NYSE, respectively, in the US.

We focus on ones whose core product or service offering had climate action as a main impact. For instance, electrical companies that have one of their many focus on power saving or energy efficiency offerings did not fit the bill. (The one exception was Epic Energy, whose primary offerings are all around energy conservation, and solar and wind-drawn products.)

It is no surprise that renewables dominate as the climate action market in India today is largely driven by the clean energy generation and supply. Electric vehicles are emerging as the country’s next climate action sector. It is mainly driven by incumbent OEMs bring out electric vehicle models as a shift towards slowly growing into the space. As OEMs go green, auto component companies naturally follow in their wake as they increasing sell parts dedicated to electric vehicles both in India and to global OEMs - testament to India’s reputation as an automative supply chain hub. Auto component companies are in fact a significant proportion of these 43 listed climate tech companies.

There are then firms that we list as partial climate techs: companies with traditionally non-climate-friendly offerings going green. These are largely established power producers and automotive and auto components companies looking to mix growth with a transition towards climate-friendly offerings, driven by a mix of investor pressure, customer demand, or regulatory norms.

Having to do this within the famously short target timeframe expected by the stock market’s quarterly returns can be difficult. Any transition will involve significant capital expenditures for infrastructure and R&D, the returns of which may only be felt after a few years. But being driven by investor sentiment can also be a favourable play for an established public listed company to transition.

Tata Motors has faced a rocky few years, but they are arguably leading the 4-wheeler electric vehicle segment in India, as small as it is. Their stock price has grown from INR 370 to almost INR 500 from October 2020, with their EV focus touted as one of the factors. The same focus led to a USD 1 billion investment by TPG, a private equity firm, into Tata Motor’s EV subsidiary. It may be early days, but demonstrating a climate or green angle is looking increasingly favourable.

Routes to listing

Indian climate tech firms have largely followed the set path to an IPO, with listing at both BSE and NSE. However, we see some notable exceptions to the rule.

Small Cap Listing: Eki Energy, one of the leading providers of carbon credits in India, is listed on the small cap index, and is quite fascinating for the rise in their stock. From a launch price of INR 147 in April 2021, their stock is now priced at INR 5,911 as of 8th December. Small cap bourses are often discounted as an option for their lack of liquidity but as Eki shows, there is room for a high growth startup to list there. Eki’s stock market success comes at the back of demonstrated revenue growth and is proof that nascent sectors like carbon trading can also garner investor interest.

Reverse Merger with a SPAC: We have previously covered Renew Power’s more unconventional route to listing in NASDAQ, through the SPAC route where they bypassed the IPO route becoming the first renewable energy player to do so; speculating that SPACs offered an interesting approach for Indian climate tech companies to list publicly. While Azure has previously followed a more conventional IPO route for a US listing, the SPAC market shows an alternative path for innovative climate tech.

Green liquidity and climate indices

Initiatives like the Net-Zero Asset Owner Alliance and the Glasgow Financial Alliance for Net Zero (GFANZ) are leading to greater investor interest, and consequently greater liquidity towards publicly-listed climate-focused companies.

Both groups have a target for their signatories to ensure that their invested assets have a net-zero emissions by 2050; i.e. the companies they invest into have to be net-zero consequently - they need to transition their operations towards net-zero operations and offerings. The members’ differing views on what net-zero should be apart, such platforms can be a catalyst for increased funding availability and indeed a trigger for climate tech firms to go public.

For the already listed climate tech companies, climate and sustainability indices play a role in bringing increased investor interest and often, better valuations. Participation in these indices also act as deterrents for these companies to stray away from their climate-positive and sustainable mission.

These are a fairly familiar set of 3-4 letter acronyms are DJSI, MSCI Climate Index and S&P 500 Sustainability Screened Index. Being a part of these indices is more than just a PR & brand visibility play to highlight a company’s sustainability intent.

They provide a mark of credibility for “finance for good” investors who look to listing in such indices on the sustainability worth of companies. Ones that drop out of indices have seen drops in their share price as a result, which is more correlation than causation.

Such things are very nascent in India, where cases like Tata Motors are currently more representative of the state of affairs: one-off big ticket items, and ones that back established players.

But the times are a-changing.

ESG investing in India

We should probably talk about ESG (Environment, Social, and Governance) investing which is often the term that people associate with climate / sustainability and investing. It works on the principle of investing in companies that are working on and are demonstrating positive work on environmental and social impacts, with an appropriate governance model to guide the organization (think independent director representation, and diversity and equity-based governance mechanisms.)

We will not name names here, but speaking to people who operate in and around the growth capital space, the common sentiment is that the ESG expectations that most ESG investors in India have (not necessarily all) is still pretty low and still largely based on compliance. This is quite different to sentiments in other parts of the world, where ESG is viewed as going beyond compliance. Perhaps having activities like CSR and social impact as compliance activities, something unique to India, is a function of this sentiment. There is also the obvious case of a lack of suitable pipeline, as most climate innovations are at an early to growing stage in the scope of Seed to Series C funders.

However, with India’s Net-Zero pledge at the COP26 Summit, it is likely that compliance will be tightened, and the direction of ESG investors will invariably follow suit. In time, such policy drivers will be a fillip for climate innovations to scale, and crack that pipeline issue.

What does the near-term hold

If the wider sentiment of asset owners, investors, policymakers, and general consumers are able to influence a sufficient shit, we will be coming to a world where climate friendly companies would fall into two brackets:

Ones that need to reduce GHG emissions in their processes and operations to deliver the same goods or services they always have; a disparate range of sectors from finance, electronics, FMCG, metals, etc.

The much smaller majority of the climate techs - which we focus on above, who actually make the goods or services that enable companies and individuals to move to a climate-friendly transition.

We feel that a broader participation of climate tech companies in public listed markets is more a matter of how soon, rather than if it will happen. We realise that except for renewables, climate tech is a growing, nascent sector with only a few companies in a position today to be suitable for public-listing.

However, cast your eyes on the bullish 2030 expectations of the value of markets like green bonds, and the clout of the Net-Zero Asset Management Alliances and you will see that big money is anticipating the entry of climate-friendly or climate-positive companies to grow in the near term. What we now need is for that pipeline of nascent, fast growing climate techs to grow to that appreciable level where they are ready for listing. The next decade is where private finance has a critical role to play, making climate tech ready for the listed world.

It is quite possible that by 2030, the list of companies in sustainability indices will constitute more of the climate techs than incumbents who are shifting towards climate positive approaches. Or, so we hope.

Engaging with Climake

As always, if you are keen to engage or talk to us on our work plans or if you have something of your own to collaborate on, reach out to us below!

That’s it for Edition #18 of our newsletter.

As always, send all feedback, compliments and brickbats our way. And of course, we do appreciate you spreading the word about this newsletter.

We’re growing to build something collaborative with you and the more the merrier!

Best,

Simmi Sareen and Shravan Shankar